You know that customers want COD whereas, as a business owner,

you just can't rely on COD orders.

I'm sure you want online payments on your store.

So, if you’re in the eCommerce space, setting up your WooCommerce store with a robust payment gateway is a wise decision.

But no worries, I'll help you choose the Best WooCommerce Indian Payment Gateway in India based on certain factors & your requirements.

In this comprehensive guide, you’ll get to know:

- Factors to consider while choosing a payment gateway

- 7 Best WooCommerce Payment Gateways in India that are reliable

- My Top 3 Recommendations on WooCommerce Payment Gateway India

- A Hassle-free way to Integrate Payment Gateway on your WooCommerce Store

- And a lot more.

So without further ado, let’s dive in…

🚀 Bottom-line Upfront: In case you're in a hurry, here's a quick summary & the

List of 7 Best WooCommerce Payment Gateways in India for 2024:

1) Razorpay – 2% per transaction + GST

2) Paytm payments gateway – 0% per transaction

3) PayUmoney – 2% per transaction + GST

4) PhonePe – 0% per transaction

5) Instamojo – 2% + Rs.3 per transaction

6) Cashfree – 1.95% per transaction

7) Stripe – 2% per transaction

Also, here's an Quick summary for best payment gateway for “purpose”…

Best Payment Gateway in India for International Transactions:

↪ Stripe, Razorpay & PayTM

Best Payment Gateway for Domestic Transactions:

↪ PayTM, PhonePe, Cashfree & Razorpay

Cheapest Payment Gateway in India:

↪ PhonePe & PayTM

Best Payment Gateway for Digital Products:

↪ Razorpay, Instamojo, PayTM

What to Look for in a Good Payment Gateway?

When it comes to payment gateways, going with the trend is something you should avoid.

There are a lot of factors that you (as a business owner) must consider but I don’t want you to go into the analysis paralysis zone & end up consuming useless information.

Based on my experience & research, I’ve listed a few factors that are worth considering:

- First things first, it must be easy to get started. A payment gateway must have Easy Customer Onboarding, have less documentation & a fast approval process. It should be designed to work for you & not vice-versa.

- Transaction fees: For each & every transaction, payment gateways charge a different transaction fee either in the form of a percentage of the transaction (for eg: 2%) or a small fee for each transaction (for eg: Rs.3). The lower the better.

- Settlement Period: In simple terms, the settlement period is the period when the acquirer (here, it’s the payment gateway) transfers the amount to the merchant (here, it’s your current/savings account).

Usually, most payment gateways have a T+2 settlement period where T is the day when a customer completes the transaction. PayTM is one exception here as you get your money in your account within 24 hours (more on this later)

- Must support multiple payment methods right from traditional Credit/Debit Cards, Netbanking to UPI payments as well as Mobile wallets.

In today's era, your payment gateway should also support International cards for international transactions so that your conversions don’t affect.

Some payment gateways such as Razorpay,

do offer Postpay & EMI facilities (more on this later)

- A payment gateway should have in-built Reporting & Analytics of at least the last 6-12 months so that you as a business owner can make better business decisions.

- It’s a no-brainer, the payment gateway must be compatible & Integrate well with eCommerce platforms. Whether you’re using Shopify or WordPress or BigCommerce.

It makes things a lot easier if your payment gateway has a WordPress plugin so that it integrates seamlessly with WooCommerce.

- Along with all these, Top-notch Security, Ease of Use, Customer Support, and Uptime & Success Rate are the key factors to consider when choosing a payment gateway.

Now that we’ve some factors, selecting a payment gateway will be much easier.

7 Best WooCommerce Payment Gateways in India that are Reliable

#1 Razorpay – 2% per transaction

When it comes to payment gateways, Razorpay is one of the most popular names in the Indian market, mainly bcoz of its simple & modern UI, ease of use & onboarding process.

Millions of businesses use Razorpay including big names such as

↪ IRCTC, Zerodha, Reliance, Nykaa, Swiggy,

↪ FirstCry, Zomato, FreshToHome, Brand Warikoo & many more.

Razorpay, founded in 2013 by Shashank Kumar & Harshil Mathur, is now one of the best Indian payment gateways for WooCommerce.

It’s an established payment gateway for online payments that allows all kinds of businesses to accept, process & disburse payments with its wide range of product suites.

Along with a payment gateway, Razaorpay also provides payment links & payment pages that enable small businesses & freelancers to get paid quickly. At the moment, Razorpay tops the list & certainly the best WooCommerce payment gateway in India.

Razorpay Pros

Razorpay Cons

Supported Payment Modes: Razorpay supports more than 100+ payment modes including all major Credit/Debit Cards, UPI payments, Bharat QR, 70+ Netbanking options & Mobile Wallets such as Amazon pay, Phonepe, JioMoney, Freecharge, MobiKwik, and Airtel Money.

Along with Domestic payments, Razorpay supports International payments from over 100+ foreign currencies with real-time currency conversions. All settlements are done in INR.

Razorpay Transaction Fees:

- No Setup fees & No Annual Maintenance charges

- 2% on Indian Domestic Transactions (Credit/Debit, Netbanking & UPI payments & Mobile wallets)

- 3% on Diners & Amex Cards, International Cards, EMI (Credit Card, Debit Card & Cardless) & Corporate (Business) Credit Cards

- 18% GST applicable on the transactions fees

Note: Above mentioned fees are of the Standard Plan which is suitable for

startups, small & medium-sized businesses.

| Type of Transaction | RazorPay Fees |

| Credit/Debit Cards & Net banking | 2% |

| UPI | 2% |

| Mobile Wallets – FreeCharge, Airtel Money, MobiKwik, JioMoney, Ola Money, PhonePe, Amazon Pay, Google Pay | 2% |

| Diners Club, Amex & International Cards | 3% |

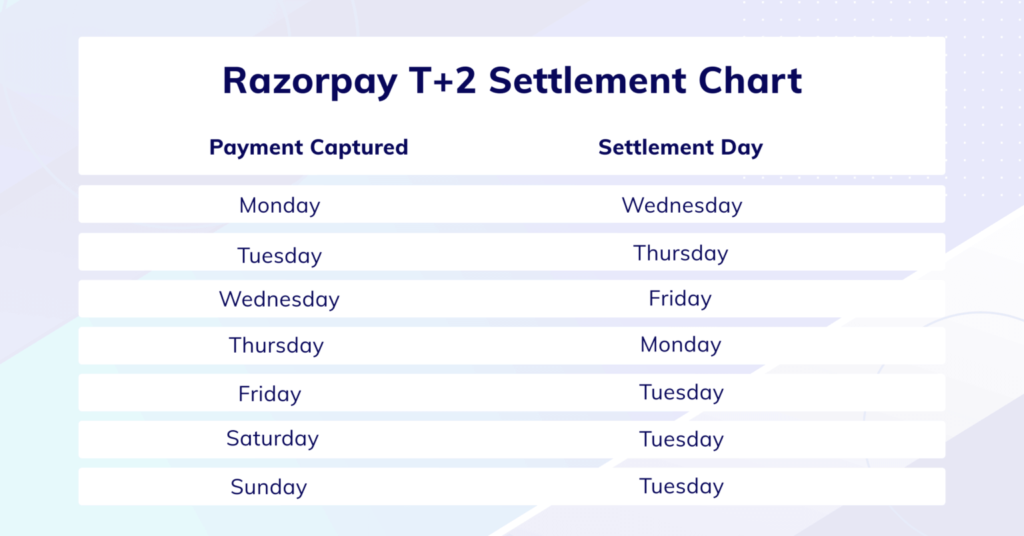

Razorpay Settlement Time: T+2 working days where T is the day of transaction capture. All settlements are done in INR.

Here’s an example…

Razorpay WordPress WooCommerce Compatibility: Yes, it’s compatible & the Razorpay plugin is available in the WordPress repository.

Check out How to Integrate Razorpay with WooCommerce.

#2 PayTM Payments Gateway – 0% per transaction

PayTM which is now a household name in India, not only offers mobile payments, and payTM wallets, but it also offers business solutions like a payment gateway, Nodal account, POS billing software & business Khata.

PayTM Payments Gateway is one of my favorite payment gateway bcoz it’s India’s most trusted payment supporting over 100+ payment sources.

PayTM powers India’s biggest online brands such as Flipkart, IRCTC, Airtel, Lenskart, Swiggy, Myntra, and many more. It's #2 on my list of the best WooCommerce payment gateways in India.

It integrates well with most eCommerce solutions including WooCommerce & the onboarding process is pretty simple, quick & easy. Along with Payment Gateway, PayTM also offers payment links, subscriptions, bank offers & much more.

I personally feel that PayTM has a slight edge over others as its paytm wallet is used by millions of people in India & when customers are offered to pay with their paytm wallet amount, conversions are pretty higher.

It supports transactions from more than 200 countries via all major international cards.

Paytm Pros

Paytm Cons

Supported Payment Modes: Paytm payment gateway supports over 100+ payment modes including all cards, all UPI apps, Paytm wallet, paytm postpaid, Netbanking, and EMI.

Paytm also supports international payments from over 200+ foreign currencies.

Paytm Payments Gateway Transaction Fees:

Note: Below mentioned fees are of the Standard Plan which is suitable for startups, small & medium-sized businesses

- No Setup fees & No Annual Maintenance charges

- UPI

- 0% on UPI Standard

- Rs.5-65 per mandate on UPI Subscription

- 1.99% on Paytm wallet

- 1.99% on Credit Card

- 1.99% on Netbanking

- Debit Card

- 0% on Rupay Debit Card

- 0.4% on Mastercard & Visa cards (if amount below Rs.2000)

- 0.9% on Mastercard & Visa cards (if amount greater than Rs.2000)

- 2.9% on International Payments (all cards)

For a better understanding, here are the transaction fees of Paytm in a tabular format…

| Type of Transaction | Fees |

| UPI | 0% |

| Paytm Wallet | 1.99% |

| Credit Card & Netbanking | 1.99% |

| Debit Card – Rupay Debit Card | 0% |

| Debit Card – Mastercard & Visa card (amount below Rs.2000) | 0.4% |

| Debit Card – Mastercard & Visa card (amount above Rs.2000) | 0.9% |

| International Cards | 2.99% |

Paytm Payments Gateway Settlement Time: 24 hours. It also offers same-day & instant settlements along with split settlements.

Paytm WordPress WooCommerce Compatibility: Yes, it’s compatible & the Paytm plugin is available in the WordPress repository.

Read How to Integrate Paytm with WooCommerce.

#3 PayUMoney – 2% per transaction

PayUmoney or rather say PayU India, is one of the leading payment gateways in India. It’s powering over 4.5 lakh merchants including some popular names such as Dream11, Airbnb, Redbus, Bookmyshow, Myntra, Ola, Goibibo, Netflix, Cred, and many more.

PayUmoney is one of the simplest and most straightforward payment gateways with simple pricing of 2% per successful transaction.

Unlike other Indian payment gateways, PayU also offers customized transaction rates if your business crosses 10 lakhs INR per month.

Similar to other payment gateways, PayU is also PCI-DSS compliant with 128-bit encryption.

It’s also known for offering one of the best success rates in transactions as it has built-in save card options, enabling customers a super-fast checkout.

PayUmoney Pros

PayUmoney Cons

Supported Payment Modes: PayUmoney supports over 100+ payment options like Cards (Visa, Mastercard, Amex, Rupay, Diner), Netbanking (75+ banks), UPI payments, Mobile Wallets, EMI options, and even Buy Now Pay Later (Lazypay, Ola postpaid).

Along with all domestic payments, PayU also accepts payments in 100+ foreign currencies & hence it’s one of the best payment gateways for both domestic & international transactions.

PayUmoney Transaction Fees:

- For Starter Plan, No Setup fees and No Annual Maintenance charges

- Flat 2% + GST per successful transaction (all payment methods, be it cards, UPI, wallet)

- Flat 3% on Amex Cards

| Type of Transaction | Fees |

| All (Credit/Debit, Netbanking, UPI, Wallets, etc) | 2% |

| Amex & International Cards | 3% |

Note: PayU also offers Business Plus & Business Premium plans where a merchant is charged a one-time setup fee for providing onboarding support, a dedicated key account manager, integration support, in-app analytics, and a few more features. Explore PayU plans

PayUmoney Settlement Time: Usually, it's T+2 working days where T is the day of transaction capture & all settlements are done in INR. Similar to Razorpay & Paytm, PayUmoney also offers instant settlements.

PayUmoney WordPress WooCommerce Compatibility: Yes, it’s compatible but the PayUmoney plugin isn't available in the WordPress repository. It's available on GitHub. Check out How to Integrate PayUmoney with WooCommerce.

4) PhonePe – 1.95% per transaction

PhonePe Payment Gateway is a highly trusted digital payment solution in India, known for its effortless integration, industry-best success rates, and comprehensive security and compliance measures.

It supports multiple payment methods, including UPI, credit and debit cards, and net banking, ensuring a seamless and secure transaction experience for businesses and customers alike. Additionally, it offers a powerful centralized dashboard for detailed reporting and insights.

PhonePe Pros

PhonePe Cons

PhonePe Transaction Fees

- Standard Plan: 1.95% per successful transaction.

- Limited Period Offer: Free for 3 months (T&C Apply).

PhonePe Settlement Time

PhonePe typically offers quick settlement times, though specific details may need to be confirmed directly with their support team.

PhonePe WordPress WooCommerce Compatibility: Yes, it’s compatible & the plugin is available in the WordPress repository.

5) Instamojo – 2% + Rs.3 per transaction

Instamojo, founded in 2012 is now a popular name in the eCommerce space, competing with the big giants. Not only does it offer an online payment gateway, but you can create your online store & do all the shipping and stuff right on the platform.

It’s more of an online selling platform for small businesses (focused on DTC brands) used & trusted by more than 2 million SMBs.

Although not the best in terms of UI UX, it offers a bundle of marketing features such as SEO, discounts and offers, custom campaigns & a lot more that are helpful for bloggers, freelancers, and small businesses.

Along with an online store & subscriptions, Instamojo offers a reliable online payment gateway that can be integrated with major eCommerce platforms including WordPress WooCommerce.

Instamojo Pros

Instamojo Cons

Supported Payment Modes: Instamojo supports all major domestic & International cards, UPI payments, net banking, mobile wallets & even pay later options.

Instamojo Transaction Fees:

Note: Below mentioned fees are for Online Payments for startups, and small & medium-sized businesses looking to integrate it with WooCommerce.

- No Setup fees, No Annual Maintenance charges & hidden fees

- 2% + Rs.3 + GST if you’re selling physical goods

- 5% + Rs.3 + GST if you’re selling digital goods (eg: ebooks, courses, etc)

- 5% + Rs.3 + GST for smart pages (landing page builder)

- Additional 1% for International Transactions

For better understanding, here are the transaction fees of Instamojo in a tabular format…

| Type of Transaction | Fees |

| Credit/Debit Cards | 2% + Rs.3 per transaction |

| Netbanking & EMI | 2% + Rs.3 per transaction |

| UPI & Mobile Wallets | 2% + Rs.3 per transaction |

| Digital Products & Smart Pages | 5% + Rs.3 per transaction |

Instamojo Settlement Time: T+3 working days where T is the day of transaction capture. You also have options for faster payouts.

- Additional 0.50% + GST for same-day payout

- Additional 0.25% + GST for next-day payout

- Additional 1% + GST for instant payout (limit of 1 lakh/day)

Instamojo WordPress WooCommerce Compatibility: Yes, it’s compatible & the Instamojo plugin is available in the WordPress repository. Check out How to Integrate Instamojo with WooCommerce.

6) Cashfree – 1.95% per transaction

Cashfree, another Indian startup by two friends launched in 2016 is now at a valuation of $200 million dollars.

Cashfree is not just a payment gateway. It offers robust payment solutions like payout processing, marketplace settlements, recurring payments via subscriptions, bank account & PAN verification, UPI Stack, Instant refunds, auto-collections & even banking as a service.

In one of the most competitive markets i.e payment processing, Cashfree has rapidly grown in the country to the point where it’s dominating the payment disbursals with more than 30% market share amount payment processors.

Cashfree is empowering over 1 lakh merchants & is used by some of the well-known brands such as Nykaa, Ixigo, EaseMyTrip, IRCTC, and many more.

Cashfree Pros

Cashfree Cons

Supported Payment Modes: Cashfree supports over 120+ payment options. For domestic payments, Cashfree supports 65+ netbanking options, Credit Card, Debit Card, NEFT, IMPS, UPI payments via BHIM UPI, Mobile Wallets, EMI, and even Pay later options.

Along with all domestic payments, Cashfree also accepts payments in 30+ foreign currencies. It also integrates with Paypal to provide express checkout & hence it’s one of the payment gateways you can use for both domestic & international transactions.

Cashfree Transaction Fees:

Note: Below mentioned fees are of the Payment Gateway only. There are a few other products offered by Cashfree which has different pricing.

- No Setup fees & No Annual Maintenance charges

- 0% on UPI and Rupay Debit Card

- 1.9% on Domestic Cards (Visa, Mastercard, Maestro)

- 1.9% on Google Pay, Phonepay & Apple Pay

- 1.9% on Netbanking

- 2.5% on Pay later & Cardless EMI

- 2.95% on Dinners Club & American Express Card

- 3.5% + Rs.7 on International Cards (Visa, Mastercard)

- 18% GST applicable on the transactions fees

For better understanding, here are the transaction fees of Cashfree in a tabular format…

| Type of Transaction | Fees |

| UPI and Rupay Debit Card | 0% |

| Credit/Debit Cards (Visa, Mastercard, Maestro) | 1.9% |

| Google Pay, PhonePe, Apple Pay | 1.9% |

| Netbanking | 1.9% |

| Pay later & Cardless EMI | 2.5% |

| Diners Club & American Express Card | 2.95% |

| International Cards (Visa, Mastercard) | 3.5% + Rs.7 per transaction |

Cashfree Settlement Time: T+2 working days where T is the day of transaction capture. With a little extra fee, they provide options like same-day settlement, holiday settlement, on-demand settlement & recently launched – within 15 mins settlement.

Cashfree WordPress WooCommerce Compatibility: Yes, it’s compatible & the Cashfree plugin is available in the WordPress repository. Check out How to Integrate Cashfree with WooCommerce.

#7 Stripe – 2% per transaction

Originated in the US, and launched in 2011, Stripe is now a global leader in the payment processing category with a market share of 15.49% & is available for businesses in 46 countries.

Stripe has recently become available for Indian businesses supporting Domestic & International card payments where you can accept payments in over 135 currencies from almost every country.

It offers a great UI & UX, comparatively better than Razorpay & many other payment gateways.

Along with a payment gateway, it offers a dozen of products including pre-built payment pages suitable for all kinds of businesses.

In spite of being so renowned, it ranks #7 on my list of best WooCommerce payment gateway in India because, at the moment, Stripe doesn't support UPI and Netbanking which is a major con & has the last one on the list.

Stripe Pros

Stripe Cons

Supported Payment Modes: Stripe supports a total of 32 payment methods. Right from card payments to buy now, pay later, it’s easy with stripe. Globally, the most popular ones are Google pay & Apple pay but if we consider India, Stripe isn’t the best solution as it doesn’t support any UPI payments & Netbanking.

Stripe Payment Gateway Transaction Fees:

Note: Below mentioned fees are of the pay-as-you-go model which is suitable for startups, small & medium-sized businesses

- No Setup fees & No Annual Maintenance charges

- Domestic:

- 2% on MasterCard & Visa Cards issued in India

- 3.5% on American Express Cards issued in India

- International:

- 3% on MasterCard & Visa Cards issued outside of India

- 3.5% on American Express Cards issued outside of India

- 4.3% for International Cards with USD or other currency + 2% fees on currency conversion

For better understanding, here’s the same data in a tabular format…

| Type of Transaction | Fees |

| Mastercard, Visa Card issued in India | 2% |

| American Express issues in India | 3.5% |

| Mastercard, Visa Card issued outside India | 3% |

| American Express issued outside India | 3.5% |

| Other International Cards | 4.3% |

Stripe Settlement Time: 5 business days in India. Initially, it may even take 7-14 days to receive your first payout from Stripe.

Stripe WordPress WooCommerce Compatibility: Yes, it’s compatible & the Stripe plugin is available in the WordPress repository. Check out How to Integrate Stripe with WooCommerce.

Final Words

Apart from these 7 payment gateways, there's one more payment gateway worth mentioning & i.e CCAvenue. It's also one of the widely used payment gateways in India by small & medium-sized businesses.

The reason I haven't included CCAvenue in the top 7 is because of its UI UX.

Anyway, I hope this comprehensive guide helped you select the

Best WooCommerce payment gateway for your online store.

Do let me know which payment gateway you're currently using or planning to use.

If you've got any questions, feel free to drop them in the comments below.

No payment gateway on this list properly supports International + Domestic Subscriptions (Auto pay) properly.

Some depend on WooCommerce Subscriptions plugin (Razorpay) but, their code has too many errors. Totally, unreliable as on 4th January 2025.

Hey Pranav, Thanks for your feedback!

I appreciate you bringing this to my attention.

I’ll be updating the content very soon to ensure it reflects the most reliable options for International and Domestic Subscriptions.

Your input is valuable, and I’m on it!

Great information and very informative and detailed. Thanks 🙏

This article is outdated and obsolete.

It doesn’t mention about CCAvenue. Also, it doesn’t mention about the hidden charges of Payumoney. Alongside payment charges, Payumoney charges 2950/- yearly (GST extra) and variable Platform Fee each month.

Thank you so much for taking the time to share your thoughts and valuable information with me.

I truly appreciate your input as it helps me keep my content relevant and up-to-date.

I understand the importance of including comprehensive details about payment gateways like CCAvenue, and I’m also aware that it’s crucial to highlight any hidden charges, such as those associated with Payumoney.

Rest assured, I am in the process of updating my article to incorporate this essential information and to ensure my readers have access to the most current and accurate data available.

Your feedback is instrumental in helping me achieve this goal, and I am grateful for your contribution. Please stay tuned for the updated version, and thank you once again for letting me know!

Howdy, would you mind letting me know which hosting company you’re using?

I’ve loaded your blog in 3 completely different browsers and I must say this blog loads a lot faster than most.

Can you suggest a good hosting provider at a reasonable price?

Kudos, I appreciate it!

Hi there, first of all, thanks for your appreciation.

I’m currently using Cloudways DO Hosting for most of my blogs including this one.

If I had to suggest a good hosting company then it would be none other than Cloudways.

The best part about Cloduways is they Offer a 3 days Free Trial & also Free Migration.

Feel free to test it out yourself & see if it’s a good fit for your blog.

Cheers,

Kuldeep